US Home Prices Declining at Accelerated Rate

We all know the housing bubble was inflated by easy credit and that market has become totally unhinged.

The Credit Market's issues are far from being sorted out. Certainly this is not going to be resolved in the short term. I think it is a fairy tail to believe the same abundant levels of consumer credit will return anytime soon. Money is going be more expensive and in shorter supply, hence we will have fewer dollars chasing houses. The next paragraph (and corresponding chart) shows why I think housing may be far from a bottom.

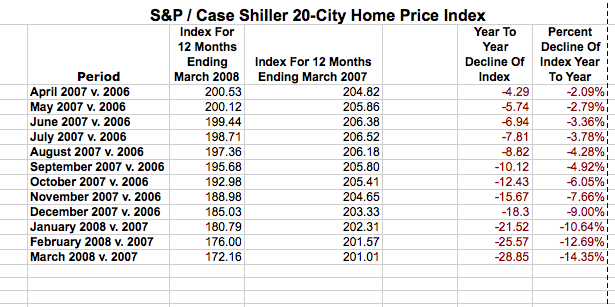

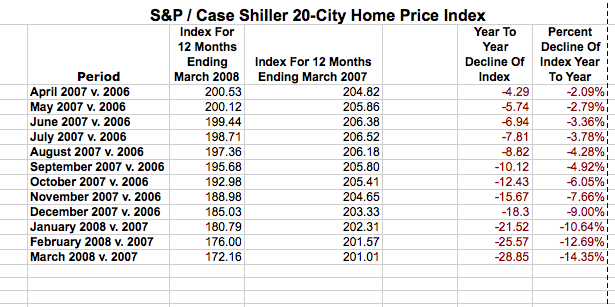

The S&P/Case-Shiller Home Price Indices are the gold standard for measuring aggregate home price fluctuations. The below chart, illustrating monthly changes in year-to-year comparisons, shows nationwide home prices falling at a faster rate each month.

The Credit Market's issues are far from being sorted out. Certainly this is not going to be resolved in the short term. I think it is a fairy tail to believe the same abundant levels of consumer credit will return anytime soon. Money is going be more expensive and in shorter supply, hence we will have fewer dollars chasing houses. The next paragraph (and corresponding chart) shows why I think housing may be far from a bottom.

The S&P/Case-Shiller Home Price Indices are the gold standard for measuring aggregate home price fluctuations. The below chart, illustrating monthly changes in year-to-year comparisons, shows nationwide home prices falling at a faster rate each month.